As China surges ahead in global shipbuilding dominance, the United States is exploring new partnerships with South Korea and Japan to bolster its naval capabilities. Senators Tammy Duckworth and Andy Kim are spearheading a mission in Asia, seeking to establish joint ventures to repair and build noncombatant vessels—an effort aimed at revitalizing America’s aging fleet and bridging the maritime power gap.

A Race Against Time and Tonnage

The U.S. shipbuilding industry is facing a steep decline. With commercial shipbuilding now representing just 0.1% of global capacity, the U.S. trails far behind China’s 53%, as well as South Korea and Japan. Senator Duckworth emphasized the urgency: “We already have fewer capacity now than we did during Operation Iraqi Freedom… We have to rebuild the capacity.”

The issue is not just volume, but time. A Navy review in April 2024 revealed that several major shipbuilding programs are delayed by one to three years, creating concern among U.S. military planners and lawmakers.

Strengthening Indo-Pacific Partnerships

During their visit to South Korea and Japan, Senators Duckworth and Kim will meet with executives from top shipbuilders in an effort to forge joint ventures that would enable the construction and repair of auxiliary vessels—noncombatant ships vital for fuel, transport, and supply operations.

“If we have to bring ships all the way back to the United States… to wait two years to be fixed, that doesn’t help the situation,” Duckworth explained, underscoring the strategic value of regional repairs.

A Real-World Case: USNS Wally Schirra

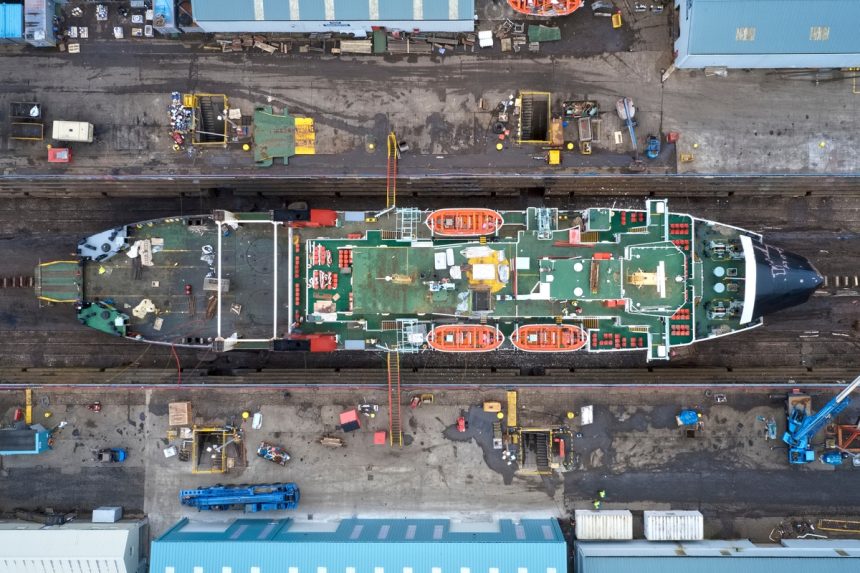

The potential for international collaboration is already taking shape. In March 2025, South Korea’s Hanwha Ocean completed its first overhaul of a U.S. Navy cargo and ammunition ship, the USNS Wally Schirra, after securing a repair agreement with the U.S. Navy in July 2024.

Hanwha’s involvement extends beyond maintenance. Its parent company, Hanwha Group, has acquired Philly Shipyard in Philadelphia—a move seen as a strategic entry into the U.S. shipbuilding market.

Investment Offers and Strategic Alignment

Earlier this month, South Korea proposed a $150 billion investment in the U.S. shipbuilding sector to support President Trump’s “Make American Shipbuilding Great Again” initiative. This came amid tariff negotiations with the White House.

Duckworth revealed she had discussions with Hyundai Heavy Industries about possible acquisitions of U.S. shipyards, potentially boosting domestic capacity with foreign capital and expertise.

China’s Growing Dominance Raises Alarm

Adding urgency to the U.S. initiative is China’s recent merger of two state-owned shipbuilders, forming the China State Shipbuilding Corporation, now the largest shipbuilding company in the world. This new giant commands 21.5% of the global market and builds everything from aircraft carriers to nuclear submarines for the Chinese navy.

Rebuilding America’s Maritime Backbone

The Biden administration and Congress appear aligned on the need to revive domestic shipyards, with the Pentagon seeking $47 billion for shipbuilding in its latest annual budget. With strategic partnerships in Asia, lawmakers hope to strengthen the U.S. Navy’s auxiliary capabilities without waiting for years of domestic rebuild.

Senator Duckworth concluded that partnerships with South Korea and Japan could help achieve both economic and national security goals: “The discussions will focus on how to build auxiliary vessels and small boats efficiently, strategically, and collaboratively.”

As geopolitical tensions rise and China expands its naval reach, the United States is racing to regain its maritime edge. With crucial allies like South Korea and Japan offering shipbuilding muscle and investment, American leaders are betting on global cooperation to reinforce their fleet and secure the Indo-Pacific. The outcome of these talks could define the future of U.S. naval readiness for decades to come.